Most Templok Ceiling projects may qualify for 40% tax credits.**

Pay less for a ceiling that does more

Make your next project more affordable and save energy with TEMPLOK Ceilings. A variety of federal and state income tax credits and deductions for energy-saving products may make your TEMPLOK ceiling projects a more affordable option than standard mineral fiber ceiling system.

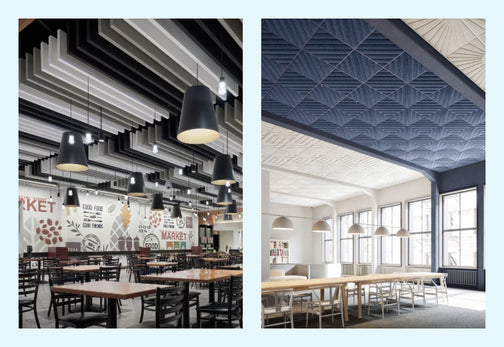

In addition to reduced energy costs, TEMPLOK ceiling panels provide exceptional acoustical performance and increased thermal comfort, benefitting both building owners and occupants for years to come.

How do TEMPLOK ceilings qualify for tax credits?

TEMPLOK Energy Saving Ceilings utilize phase change material (PCM) to transform these large surface areas into more sustainable, resilient spaces. TEMPLOK phase change material provides thermal energy storage, which falls under an energy-efficient, energy-saving, or energy-generating products that qualify for incentives.

Who qualifies?

All eligible taxpayers and non-taxable entities including:

- For Profit Building Owners

- School Districts

- Other Government Entities

- 501 (c)(3) Charitable Organization

Ideal projects

- K-12 Schools

- Universities

- Hospitals

- Non-profit

- Offices

- Transportation

- Convention Centers

- Sports Arenas

- Government Buildings

Investment Tax Credit (ITC) breakdown

Inflation Reduction Act of 2022, Section 48E

The purchase and installation of Armstrong Templok Energy Saving Ceiling Tiles (including support systems/grid and labor) may qualify for a federal investment tax credit of up to 50% because Templok ceiling tiles have thermal energy storage properties (phase change material in the ceiling).

-

-

Get a 50%

Total credit amountIf TEMPLOK Energy Saving Ceilings are deployed in an “Energy Community” (a Brownfields site, or certain fossil fuel dependent communities) an additional 10% tax credit may be available.

Not all areas will qualify for this credit. Consult your tax advisor to determine your eligibility.

Subcopy goes here. This is a text link

* This document lists various federal tax credits and deductions that your project may qualify for when purchasing TEMPLOK Energy Saving Ceilings. Please consult your own tax attorney or advisor.

** The project meets one of three requirements: 1. Meeting < 1MW thermal energy storage/year (estimate < 890K SF Templok), 2. Beginning construction before January 29, 2023 OR 3. Prevailing Wage & Apprenticeship requirements.

Ready to save on energy?

Contact us today to discuss your next TEMPLOK project, the process for claiming tax incentives, and your potential savings:

-

Call Us:

(866) 438 8833(Mon-Fri 8AM-8PM EST) -

Chat With Support

Thanks for subscribing!

Thanks for subscribing!